dependent care fsa income limit

The American Rescue Plan Act of 2021 gives employers the option to increase the dependent care flexible spending account DCFSA reimbursable limit to 10500 5250 for married couples filing separate tax returns for the 2021 calendar year. The american rescue plan boosts the dependent care fsa limit to 10500 for 2021.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses.

. For example if an employer has elected a 2000 contribution to a Dependent Care FSA. If you have a dependent care FSA the annual contribution. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. These limits apply to both the calendar year January 1December 31 and the plan year July 1June 30. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

Married file separate returns 2500. Parents can use their Dependent Care FSA to cover nanny expenses provided they care for young children in the home so that both parents can work. This was part of the American Rescue Plan.

If your tax filing status is Single your annual limit is. You may enroll in an FSA for 2022 during the current Benefits Open Season which runs through December 13 2021 midnight EST. The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year.

Use pre-tax dollars to help offset the cost. The contribution limit is 2850 up from 2750 in 2021. Employers can also choose to contribute to employees Dependent Care FSAs.

Dependent Care FSAs DC-FSAs also called Dependent Care Assistance Plans DCAPs 2022. In order to take a distribution from the dependent care FSA for a parents dependent care expenses the parent must be a tax dependent under IRC 152 as modified by 21 b 1 B who is a physically or mentally incapable of caring for himself or herself and b has the same principal place of abode as. The carryover limit is 550 for the 2021 income.

The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for single taxpayers and married couples filing jointly and to 5250 up from 2500 for married. 125i IRS Revenue Procedure 2020-45. If your tax filing status is Married.

If your spouse has a Dependent Care FSA through his or her employer and you file a joint tax return your combined deposits cannot exceed 5000. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time. Accordingly employees can have the full amount of their dependent care FSA benefits excluded from incomeeven in excess of the appliable 10500 or 5000 calendar year limitprovided the excess amount available is attributable to the.

This alert addresses how to adopt the relief potential. Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals. The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

Dependent Care FSA for Parents. Ad Increase your take-home pay and decrease your medical expenses with FSA benefits. The maximum amount you can contribute to the Dependent Care FSA depends on your marital status your tax-filing status and income.

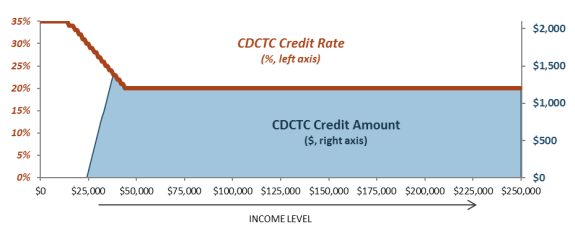

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. Dependent care FSA increase to 10500 annual limit for 2021. Your employer may elect a lower contribution limit.

Single file as head of household 5000. However your contributions may not be in excess of your earned income for the plan year. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately.

5000 if your 2021 earnings were less than 130000. Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. It remains at 5000 per household or 2500 if married filing separately.

As an annual account. If you are married and filing separately you may contribute up to 2500 per year per parent. When Signing Up For Dependent Care Fsa For 2021.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. However the combined employer and employee contributions cannot exceed the IRS limits the maximum annual amount is 5000 per year or 2500 if you are married and file separate returns. Zero Guesswork When You Shop 6000 Eligible Items at FSA Store.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. 3600 if your 2021 earnings were 130000 or more. Employers can choose whether to adopt the increase or not.

Your contributions come out of your pretax income which lowers your income and payroll taxes. Maximum Annual Dependent Care FSA Contribution Limits. However if you did not find a job and have no earned income for the year your dependent care costs are not eligible.

If you are married and file separate tax returns the most you can contribute is 2500. The limit will return to 5000 for 2022. A Dependent Care FSA DCFSA.

The minimum annual election for each FSA remains unchanged at 100. Ad The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. In these cases nannies meet the essential qualifying criteria and charges easily exceed the 5000 limit.

Back to main content Back to main content. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary IRS annual contribution limit for 2022.

This means that an employee can set aside 10500 in a dependent care fsa if their employer has one instead of the normal 5000. Maximum salary deferral single taxpayers and married couples filing jointly 5000. The IRS released its accompanying guidance IRS Notice 2021-26 in May.

For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent. Married file a joint return 5000.

Child And Dependent Care Tax Benefits How They Work And Who Receives Them Everycrsreport Com

What Is A Dependent Care Fsa Wex Inc

Pin By David K Blanton Cpa Pllc On For Work Cpa Accounting Income Tax Preparation Accounting Firms

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

New 2022 Brochure For Dependent Care Assistance Plan Fsa Benefit Plan Document Core Documents

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The Right To Pay No More Than The Correct Amount Of Tax Tax Payment Accounting Firms Cpa Accounting

Editable Charitable Contributions Receipt Template Excel Receipt Template Donation Form Business Letter Template

Browse Our Image Of Medical Insurance Receipt Template Invoice Template Receipt Template Medical Insurance

What Is A Dependent Care Fsa Wex Inc

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Explore Our Free Dependent Care Fsa Nanny Receipt Template Receipt Template Care Templates